Home equity line of credit with poor credit

Here we take a closer look at landing a home equity loan if you have relatively bad credit. Home equity line of credit.

3 Smart Ways To Use Home Equity Truist

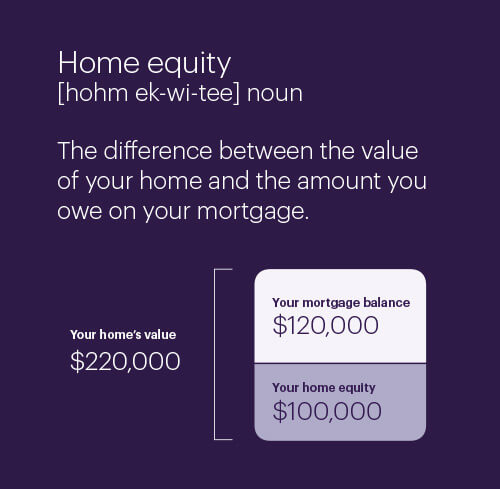

A home equity loan allows you to take a lump-sum payment from your equity.

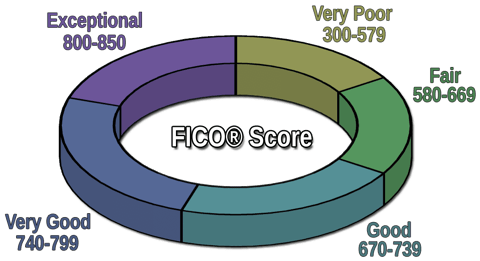

. The lower the score the more likely you are to be charged a higher interest rate. Even those with excellent credit should be aware that every time you apply for a new line of credit it can ding your credit score. Business line of credit.

I am looking for a land. Before taking out a home equity loan be careful. Another way to leverage home equity is through a home equity line of credit or HELOC.

These usually have adjustable interest rates. A HELOC allows you to borrow up to a certain limit set by your lender and you only pay interest on the amount you actually borrow similar to a credit card. A home equity line of credit is a popular way for homeowners to finance repairs.

Mortgage lending is a major sector finance in the United States and many of the guidelines that loans must meet are suited to satisfy investors and mortgage insurersMortgages are debt securities and can be conveyed and assigned freely to other holders. Home equity line of credit. Key Takeaways Home equity loans allow property owners to borrow against the debt-free value of their homes.

A low credit score can make it harder for students to get. Home Equity Line of Credit - Rates are based on a variable rate second lien revolving home equity line of credit for an owner occupied residence with an 80 loan-to-value ratio for line amounts of 50000 or 50000. You can withdraw as much as you want up to the credit limit during an initial draw period that is usually up to 10 years.

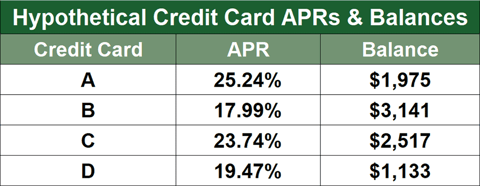

In the US the Federal government created several programs or government sponsored. A home equity line of credit HELOC lets you borrow against the available equity in your home just like a home equity loan. Borrowers can use HELOC funds for a variety of purposes including home improvements education and the consolidation of high-interest credit card debt.

2 After that your rate will be 1074 APR for the Transparent card and. Home Equity Line of Credit. Discount indicates the amount of reduction in the Rate for having monthly payments automatically deducted from an account and.

Having a low credit score in college has the potential for students to start their adult lives on poor financial footing. The 0 Period Will End Eventually that promotional interest. This is a case of being house rich and cash poor.

A home equity loan or a home equity line of credit HELOC. And thats why you may want to consider taking out a 15-year mortgage. For more information refer to What You Should Know About Home Equity Lines of Credit a guide by the Federal Reserve Board.

There are two major types of second mortgages you can choose from. Some HELOCs require that a minimum amount is disbursed initially but there are no closing costs. The draw period typically lasts around 10 years.

Or properties in poor condition. Our Transparent VISA card and our Platinum Rewards VISA card both offer a low introductory rate of just 390 APR 1 on purchases balance transfers and cash advances for the first six months your new Transparent or Platinum Rewards card account is open. For home equity loans and home equity lines of credit HELOC lenders typically offer financing for a relatively high percentage of the loan-to-value the amount left on the first mortgage compared to the market value of the home.

Unlike a home equity loan a HELOC allows you to borrow against your equity repeatedly and then pay off the balance much like a credit card. I generally recommend you. A HELOC is a second mortgage with a revolving balance like a credit card with an interest rate that varies with the prime rate.

Your home is used as collateral meaning if you default on your. However in some cases lenders will. Talk to a Qualified Credit Counselor.

When you take out a home equity loan your second mortgage provider gives you a percentage of your equity in cash. A home equity line of credit is a type of second mortgage that allows homeowners to borrow money against the equity they have in their home and receive that money as a line of credit. Introductory Rates with FHB Auto Payment 299 APR1 Fixed for 2 years 329 APR1 Fixed for 3 years.

Featured Benefit for Lanco FCU Members Home Equity Loan Special Offer. Your credit score is one of the key factors in qualifying for a home equity loan or a home equity line of credit HELOC. Apply by Labor Day to lock in low rate and enjoy cost-savings.

Introductory Rate on Our VISA Credit Cards. Like a home equity loan a home equity line of credit HELOC uses your home as collateral. A home equity line of credit or HELOC works like a credit card.

A home equity line of credit HELOC is a type of home loan in which you borrow with your homes equity as collateral. Unlike a home equity loan a HELOC is similar to a credit card except you have a specific draw period when you can make charges. An appraisal is required for home equity lines that are simultaneously opened with a mortgage and secured on the same property if the aggregate value of both loans is.

Revolving line of credit - You can withdraw the funds at any time for more flexibility. A FICO score of at least 680 is typically required to qualify for home equity loans according to Experian one of the three major credit. If you want to build equity in your home quickly then the more principal you pay down sooner the easier that becomes.

If you need access to just a little cash quickly or have a poor credit score.

Can I Get A Home Equity Line Of Credit With Bad Credit Credit Karma

Homeowners Are Sitting On A Record 6 Trillion In Equity Why Aren T They Using It Home Equity Equity Line Of Credit

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

Home Equity Line Of Credit Heloc Rocket Mortgage

Pre Approved Car Loans For Bad Credit Helps Bad Credit Car Buyers To Get Behind The Wheel

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

Home Equity Line Of Credit Heloc Rocket Mortgage

Equity Mortgage Home Equity Equity Line Of Credit

Home Equity Line Of Credit Heloc Rocket Mortgage

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

Home Equity Loan Vs Personal Loan Which Is Better For You Home Equity Loan Personal Loans Home Equity

:max_bytes(150000):strip_icc()/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

Home Equity Line Of Credit Heloc Rocket Mortgage

Home Equity Line Of Credit Heloc Rocket Mortgage

How To Get A Home Equity Loan With Bad Credit Forbes Advisor

If You Want To Pay Off Your Mortgage Early In Five To Seven Years You Can Using A Simple Home Equity Line Of Credit Also C Line Of Credit Home Equity Heloc